I had the pleasure of walking with Satyajit Das one morning recently but only because I requested some of his time to explain to me the Greek debt crisis.

When you have a simple mind like mine you need to be explained things in simple terms. Economists like 'Das' (I am told nobody calls him Satyajit which personally I think is a really cool name) are unique in the sense that they can break down really complex structures, systems and literally hundreds of millions of unique transactions to look for trends and key understandings about this ever changing world of global finance.

Within a few minutes of walking with Das I was able to know more about what was happening in Greece than anything that I could get out of a newspaper or out of a friend who was returning from Athens with reports of how the country was progressing.

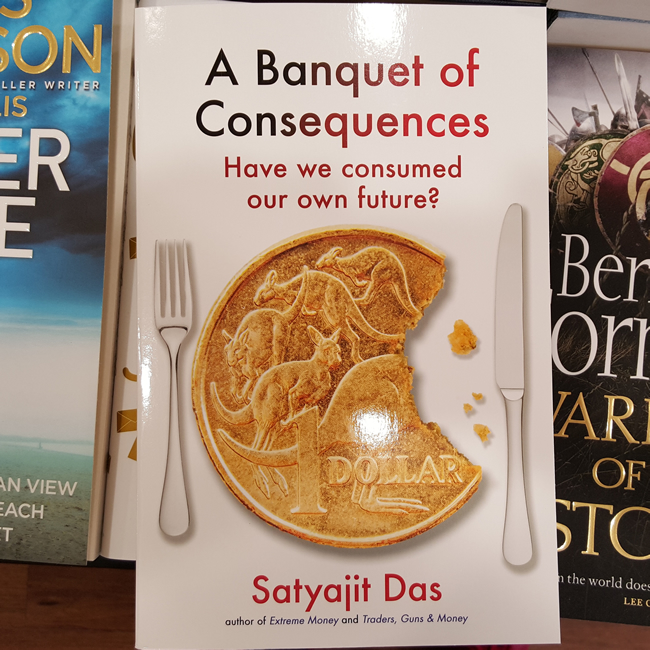

I decided to purchase his book 'A Banquet Of Consequences' and I must say that so far it has really blown me away in terms of being able to adequately comprehend movements of funds between banks and businesses, between governments and banks and between governments and citizens and everything in between.

But more importantly, everything that we witness today in our global economy is a flow on effect of so many significant changes to financial markets and regulations that often it's not until someone breaks down the historical moments in time which caused certain triggers that you can begin to understand how such a gigantic global debt crisis is .... a banquet of consequences. My opinion of the author was only bolstered when the following day there was a massive sell down of Australian mining stocks.

I highly recommend this book. I only wish that these economists would find us ways out of the fox hole rather telling us that we better be ready to jump into one.

|

| The end of endless credit looms near. It is time for us to get back to work and pay back our borrowings - which makes it uncomfortable to read this book on a sofa. |

No comments:

Post a Comment